Essential Preparation Tips for Finance Exam Success

Finance exams, like the one in the attached sample, often test a student’s ability to apply core financial concepts to real-world scenarios. Whether it's time value of money, bond valuation, or stock pricing, preparing effectively requires a structured approach. Success in such exams depends not only on understanding the formulas but also on being able to apply them correctly under time constraints. For students looking for Finance Exam Help, mastering these concepts is crucial to achieving top scores. The right preparation strategy, combined with effective study resources, can make a significant difference in performance. If you ever find yourself struggling with these complex topics, seeking support from an Online Exam Taker or utilizing online study platforms can be a great way to reinforce your understanding. This guide will help you master the required topics, improve your problem-solving speed, and develop strategies to excel in the exam hall. We will discuss in detail the essential finance topics, study techniques, and strategies to maximize performance during the exam.

Understanding Key Finance Concepts

Finance is a broad discipline that requires mastery of mathematical concepts, analytical thinking, and the ability to apply theoretical principles in practical situations. To succeed in finance exams, it is crucial to understand the fundamental concepts thoroughly and develop problem-solving strategies.

1. Time Value of Money (TVM)

The time value of money (TVM) is one of the most fundamental concepts in finance. It is based on the premise that a dollar received today is worth more than a dollar received in the future due to its earning potential.

a. Future and Present Value Calculations

The ability to calculate the present and future value of money is crucial for solving many financial problems. The primary formulas used are:

- Future Value (FV) Formula:This formula helps determine the amount an investment will grow to after a certain period at a given interest rate.

- Present Value (PV) Formula:This formula is used to discount future cash flows to their present value, making it essential for investment decisions and valuation models.

b. Interest Rate Compounding

Interest rates can be compounded at different frequencies (annually, semiannually, quarterly, monthly, or even daily). Understanding these variations is crucial for evaluating investment returns accurately.

- Compounded interest formula:Where m is the number of compounding periods per year.

- Effective Annual Rate (EAR) Formula:The EAR helps compare different financial products with different compounding intervals.

c. Loan and Annuity Calculations

Finance exams often include problems on loans, mortgages, and annuities. Key formulas include:

- Present Value of Annuity:This formula helps calculate the value of a series of equal payments over time.

- Loan Amortization Schedule:Loan payments are divided into principal and interest portions, and understanding these calculations helps in structuring repayment schedules.

2. Bonds and Fixed Income Securities

Bonds are a significant part of financial markets, and understanding their valuation and pricing mechanisms is essential for finance students.

a. Bond Valuation

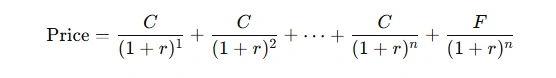

The price of a bond is determined by discounting its future cash flows (coupon payments and face value) using the yield to maturity (YTM). The formula is:

Where C is the annual coupon payment, F is the face value, and n is the number of years to maturity.

b. Yield to Maturity (YTM)

YTM is the internal rate of return (IRR) on a bond if held until maturity. Finance exams often require students to calculate YTM iteratively, as there is no simple closed-form formula.

3. Stock Valuation and Market Efficiency

Stock valuation is another crucial area in finance exams, covering different models and pricing mechanisms.

a. Dividend Discount Models (DDM)

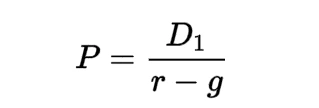

The DDM assumes that the value of a stock is the present value of all its future dividends. The most common version is the Gordon Growth Model:

Where D1 is the next year’s expected dividend, r is the required return, and g is the dividend growth rate.

b. Capital Gains and Dividend Yield

Total return on a stock is comprised of:

- Dividend yield:

- Capital gains yield:

c. Market Efficiency Forms

The Efficient Market Hypothesis (EMH) suggests that markets incorporate all relevant information into stock prices. The three forms of market efficiency are:

- Weak-form: Past prices do not predict future prices.

- Semi-strong form: Publicly available information is reflected in prices.

- Strong-form: All information, including insider data, is reflected in prices.

Effective Study Strategies for Finance Exams

Success in finance exams requires a combination of theoretical knowledge and problem-solving skills. Here are some study strategies to enhance your preparation.

1. Practice with Past Exam Questions

- Solve past papers under timed conditions to simulate exam scenarios.

- Identify common question patterns and focus on high-yield topics.

2. Master Financial Formulas

- Create a formula sheet with essential equations and their applications.

- Practice applying formulas across different question types.

3. Use Financial Calculators and Excel

- Learn how to efficiently use a financial calculator.

- Practice using Excel for calculations like NPV, IRR, and bond valuations.

Exam Hall Strategies: Handling Finance Questions Effectively

Even with solid preparation, performing well in the exam requires effective time management and strategic answering.

1. Time Management

a. Allocate Time per Question

- Distribute time based on the weight of each question.

- Don’t spend too long on a single question.

b. Attempt Easier Questions First

- Secure marks on straightforward questions before tackling complex ones.

2. Showing Work for Full Credit

a. Clearly Present Your Calculations

- Even if your final answer is incorrect, clear steps can earn partial credit.

b. Use Proper Financial Notation

- Clearly indicate PV, FV, interest rates, and time periods.

3. Managing Stress and Staying Focused

- Take deep breaths to stay calm.

- Read each question carefully before solving.

Conclusion

Finance exams require conceptual understanding, problem-solving efficiency, and time management. By mastering key topics, practicing consistently, and applying strategic exam techniques, you can greatly enhance your performance. Regular practice of numerical problems, effective use of financial formulas, and familiarity with exam-style questions will improve your confidence. Additionally, managing stress and pacing yourself during the exam will prevent careless mistakes. Remember to approach your studies with discipline, utilize past papers, and refine your analytical skills to succeed. With diligent preparation and a methodical approach, you can perform exceptionally well in your finance exams.